Bank of America Crypto-currency Trading

Investors who are looking to trade popular cryptocurrencies, such as BAT, Bitcoin, Bitcoin Cash,

Cardano, Dogecoin, Ethereum, Litecoin, Shiba Inu, NEO, Ripple, Stellar, cannot do it on Bank of America.

The broker simply does not offer them. For Ethereum, Bitcoin, Bitcoin Cash, Litecoin, Dash, Zcash, Stellar,

Dogecoin, and many more coins trading, investors can use a

$0-fee Webull.

Webull Promotion

Open WeBull Account

Bank of America Overview

Bank of America, up until recently one of the most trusted banking institutions in the country, has not

been able to regain its prestigious status since the government bailout. As a result of certain mitigating

factors associated with the acceptance of government money, specifically, the requirement to purchase

Merrill Lynch (including a huge debt from the sub-prime mortgage fiasco), their reputation has suffered

along with their ability to attract new customers and retain current customers. Consequently, interest

rates have taken a nose dive - particularly rates associated with IRA products.

Low Interest Rates

As of 2024 the interest rates in many companies are at unprecedented levels, in some cases as low as 0.01%.

The days of investing for retirement via IRA's and earning a nominal rate of return, 3%-5%, are

nonexistent with little hope for any rebound in the foreseeable future. Even the attractive rates of 2%-3% for

long term (60 month) IRA CD's which were available just a few short years ago have disappeared.

If you were lucky enough, or smart enough, to have opened a few long term IRA CD's when the rates

were between 2.5% and 3% you are reaping the rewards. But right now Bank of America

has very little to offer in the way of IRA CD's or investments that would attract the average customer.

The options for IRA contributions include both Roth and Traditional IRA's which can be invested in two

categories:

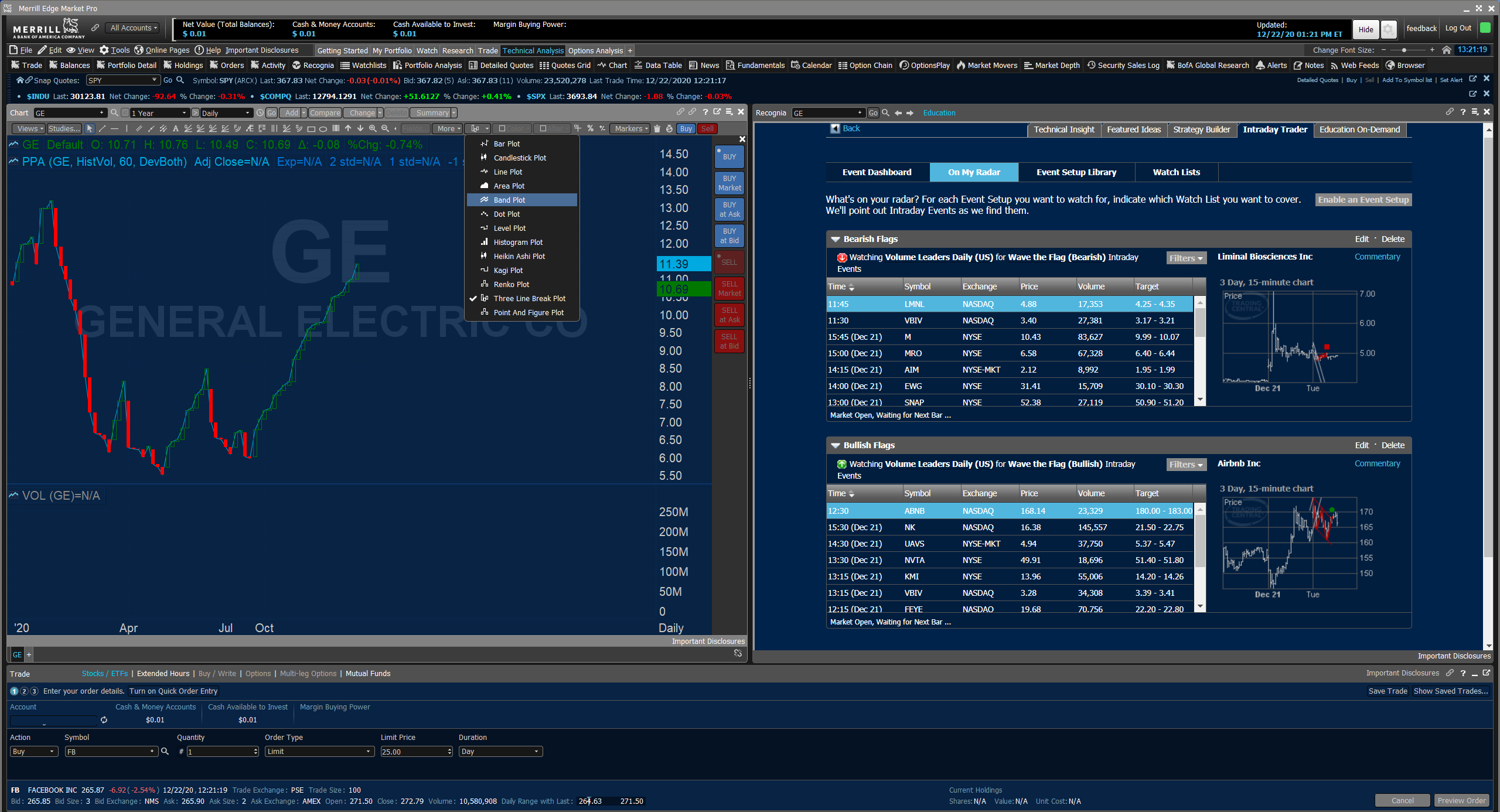

- Investment products offered by Merrill Edge - Mutual Funds, Stocks, Bonds and ETFs

- Products offered by Bank of America - Money Market IRA, Featured CD IRA

A report in Barron's: The Best Online Brokers of ranked Merrill Edge 11th

out of 20 with an overall score of 4.0 stars where the maximum was 4.5 and the minimum was 2.0. On

its face this would seem to bode well for them - but further analysis reveals that their trading experience

and technology only earned a 3.0 and their costs a poor 2.8 - both of which are significant factors when

deciding on retirement investment vehicles.

Bank of America IRA CD's

Bank of America has completely restructured their CD rates from what you have come to expect

from one of the premier financial institutions in the country. They offer a variety of options for IRA CD's:

- Featured CD IRA - 0.07% APY for 12 months with minimum deposit of $2,000.

- Standard Term CD IRA - 0.01% - 0.15% APY with minimum deposit of $1,000. The rate

varies based on term from 6 months to 10 years. (0.15% requires 4 year minimum term)

- Variable Rate CD IRA - 0.02% APY for 18-23 months with minimum deposit of $100.

- Risk Free CD IRA - 0.04% APY for 9 months with minimum deposit of $2,000.

- Money Market IRA - 0.05% - 0.15% APY no term limit and minimum deposit of $100.

If you are a Platinum Privileges client (minimum of $50,000 in combined assets on deposit) you can

qualify for higher rates on the IRA CD's:

- Featured CD IRA - 0.12% APY for 12 months with minimum deposit of $2,000.

- Standard Term CD IRA - 0.04% - 0.20% APY with minimum deposit of $1,000. The rate

- varies based on term from 6 months to 10 years. (0.15% requires 4 year minimum term)

- Variable Rate CD IRA - 0.04% APY for 18-23 months with minimum deposit of $100.

- Risk Free CD IRA - 0.08% APY for 9 months with minimum deposit of $2,000.

|