Cryptocurrency Trading at Charles Schwab

Investors who are looking to trade popular cryptocurrencies, such as BAT, Bitcoin, Bitcoin Cash,

Cardano, Dogecoin, Ethereum, Litecoin, Shiba Inu, NEO, Ripple, Stellar, cannot do it on

Charles Schwab. The broker simply does not offer them. For Ethereum, Bitcoin, Bitcoin Cash, Litecoin, Dash, Zcash, Stellar,

Dogecoin, and many more coins trading, investors can use a

$0-fee Webull.

Webull Promotion

Open WeBull Account

Charles Schwab Commissions, Fees and Account Requirements

If you're looking for a low-cost broker, Schwab should be at the top of your list. Stock and ETF transactions cost a very low $0 per trade.

This commission is matched by Firstrade. Placing a trade over the broker's automated phone

service costs an extra $5. Using a live representative is an extra $25. Option contracts cost an extra 65¢ each.

Mutual funds that aren't classified as NTF cost $49.95 to buy, but there is no charge to sell. This rate is higher than at many

other brokers, such as Firstrade and Ally Invest which are both at $9.95.

Treasuries and new issues of fixed-income products are priced on a markup/markdown basis. This means that there is no commission, although the price includes a concession to Schwab. Bonds on the secondary market, including government agency bonds and zero-coupon Treasuries cost $1 each. Schwab here imposes a $10 minimum and $250 maximum.

As with retirement accounts, a regular brokerage account comes with no on-going fees. The brokerage house does require a $1,000 deposit to open

a securities account; although this policy is waived if you open a Schwab Bank account at the same time.

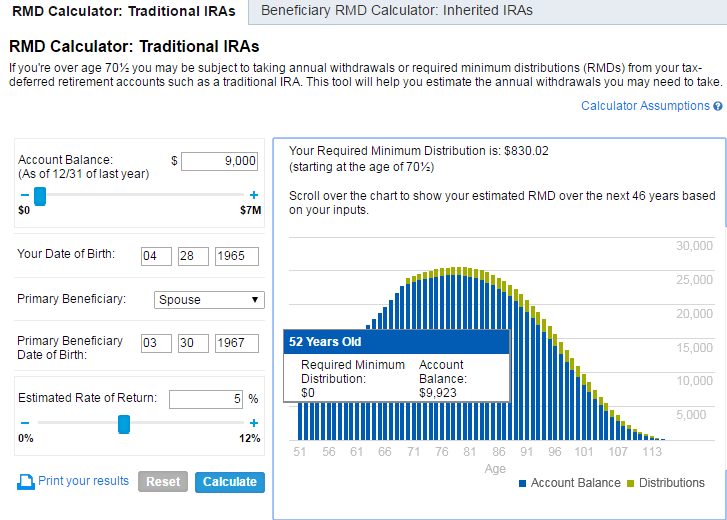

IRAs

Besides its taxable accounts, Schwab also offers retirement accounts. The brokerage house has a large selection of IRA's, including Traditional,

Roth, Rollover, Inherited, and Custodial versions. SEP and SIMPLE accounts are available as well.

There is no annual or maintenance fee for an IRA at Schwab, and the broker also doesn't require any minimum balance to open one. There is no

minimum balance fee, either. A Schwab IRA is a no-fee account, which is very generous.

Besides the IRA itself, Schwab also has a good retirement section on its website that would be especially helpful for do-it-yourself investors

who need a little extra guidance. While browsing through the section, we found a retirement income planning quiz, which tested our knowledge of

how to correctly plan and save for life after work. There are other helpful resources as well.

If you're self-employed, you'll be well-served by a Schwab solo 401(k) plan. This too comes with zero fees and all of Schwab's trading tools.

Both 401(k)'s and Individual Retirement Accounts come with the same commission schedule that taxable accounts have. We'll now take a look at

what exactly Schwab charges for trading securities.

Investment Advice

The rise of artificial intelligence has not gone unnoticed in the financial world. Schwab has a software program that is able to buy and sell inexpensive exchange-traded funds, and this service is cheaper than traditional human investment advisors. There are two plans available. The first requires a $5,000 minimum and amazingly costs nothing. Schwab is able to waive the management fee by holding a large cash position in the account, which it invests and makes money from; and by receiving compensation from the fund families that provide the ETF's.

The second plan costs 0.28% per year and requires $25,000 to begin. This second plan comes with a portfolio review by a Certified Financial Planner, so it's a sort of hybrid robo-human service. Hence the fee.

Besides the broker's computerized trading service, traditional managed accounts are still available. There are several varieties to choose from, and they cost between 20 and 90 basis points, depending on account balance and strategies chosen. Some packages include stocks, bonds, and mutual funds. Minimum deposit ranges from $25,000 up to $100,000.

Research and Education

Schwab traders have access to a large selection of learning materials on the company's website. There are many news articles from outlets such as Reuters. Schwab offers articles written by its own financial experts on countless topics, such as option strategies and how to trade ETF's.

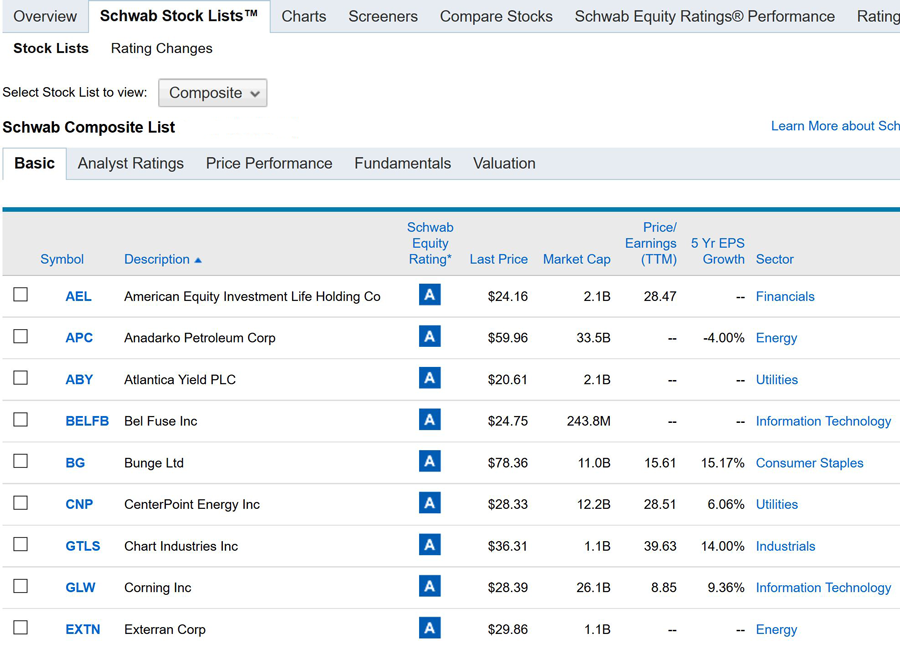

A stock's profile page has a wealth of information on it. This includes not only immediate trade data, such as volume and bid-ask spread, but also dividend information and any outstanding preferred shares.

We thought the best feature was the stock reports Schwab offers. Many analysts are available, and their insights can be downloaded in pdf format

free of charge. Ford Motor Company had seven reports available from researchers such as Morningstar and Argus. Schwab has its own grading

system as well.

Schwab doesn't limit itself to just American financial instruments. It has a large selection of information on its site devoted to global stocks. For example, Schwab Equity Ratings International covers more than 4,000 stocks. There is also an account that can be opened that has the ability to trade on foreign markets.

Banking Features

Hands down, Schwab has one of the best bank accounts available in the United States, brokerage or otherwise. Schwab Bank is FDIC insured, and although Schwab obviously had its investment customers in mind when it built this financial institution, you don't need a securities account to open one of the company's bank accounts.

Schwab's checking account comes with free checks and a Visa debit card. ATM fees incurred anywhere on the globe are reimbursed, and there is no monthly limit on this policy. We don't know of any other bank that has this rule.

Currently, Schwab's checking account pays just 0.20% per annum in interest. This isn't very much, but it is higher than several traditional banks.

Other Financial Services

Besides its securities investing and banking services, Charles Schwab works in many other financial areas. Schwab has advisors who specialize in estate planning, for example. Besides the guidance the company offers in this area, trust and estate accounts can be opened.

Futures trading at Schwab is available in a separate account. It can be linked to a Schwab bank or brokerage account. Contracts are $3.50 per side. A discrete browser platform, taken from optionsXpress, is used to trade futures.

Schwab offers some helpful resources to save for education. These include a 529 plan, a custodial account, and an Education Savings Account.

Charles Schwab Review Summary

As you see from the above brokerage review, Charles Schwab underperforms some of its peers in a few areas, which is why a half star was deducted

in a small number of categories. But it manages to deliver an overall impressive performance.

|