Cryptocurrency Trading at Fidelity

If you’re thinking about trading Bitcoin with a Fidelity brokerage account, you’ll have some roadblocks, but it’s not impossible. Here’s how to tap into the cryptocurrency market with this broker:

Fidelity’s Bitcoin Mutual Fund

Fidelity recently launched the Wise Origin Bitcoin Index Fund. It invests solely in Bitcoin and is passively managed. The fund has a minimum investment of $100,000 and is intended for qualified purchasers who meet stringent criteria. Generally, this means you’ll need deep pockets and might have to be an institution. An institution is an investment group like a hedge fund, pension fund, or mutual fund. If you have first and last names, chances are you’re a retail investor and won’t be able to invest in this new fund.

The Bitcoin Index Fund is only available through Fidelity Digital Funds, a new business unit of the brokerage house.

Fidelity Blockchain ETF

If you can’t invest in Fidelity’s new Bitcoin fund, you could instead trade blockchain ETFs. These are exchange-traded funds that invest in stocks that are connected one way or another to blockchain technology.

The blockchain is a decentralized database that records in digital form every cryptocurrency transaction. Many companies are investing heavily in this new digital ledger due to its potential ability to combat fraud.

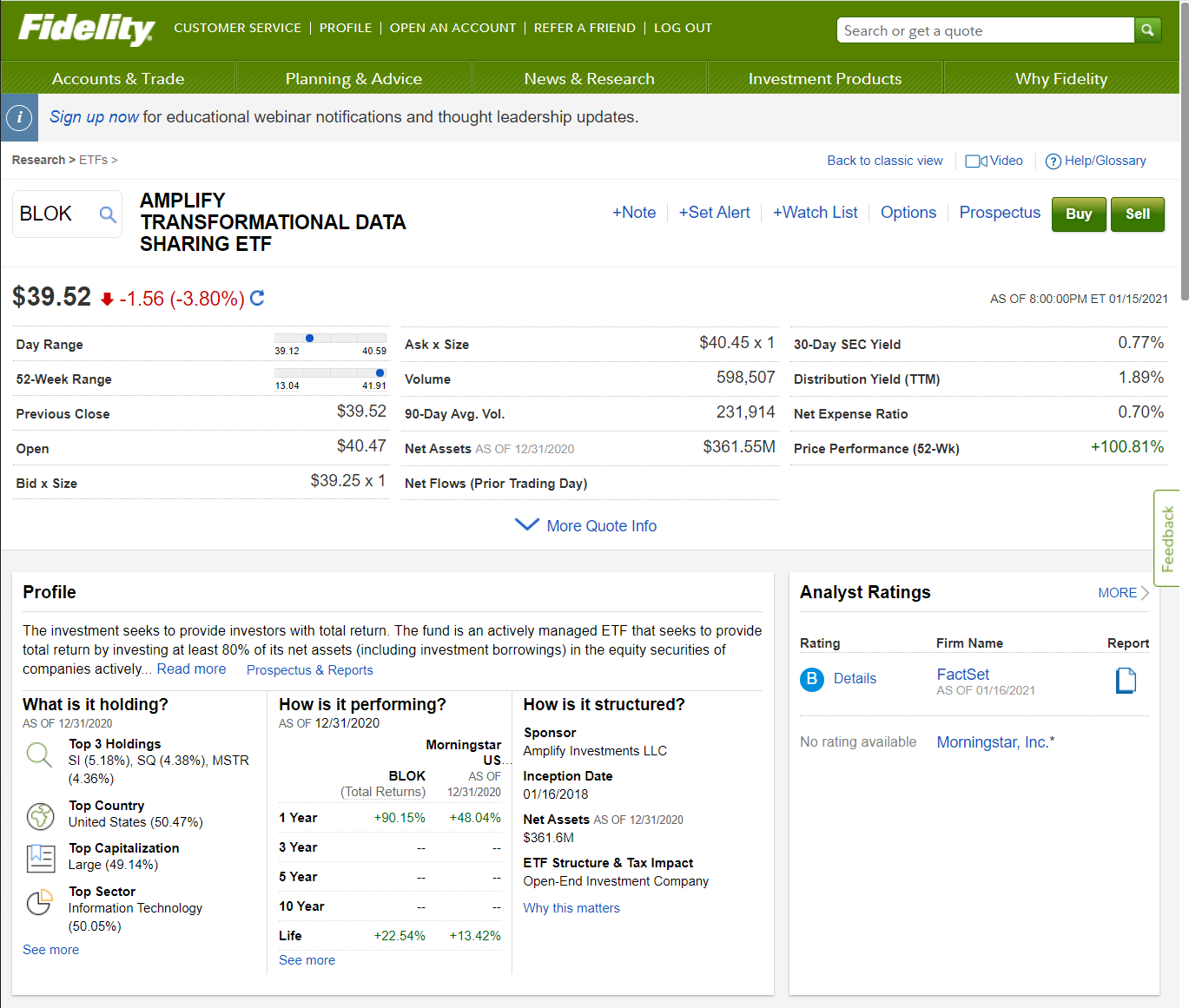

One blockchain fund we found on Fidelity’s site is BLOK, the Amplify Transformational Data Sharing ETF. This fund has half a billion dollars in assets and invests in over 50 companies. Examples include:

- Alibaba

- NVIDIA

- HIVE Blockchain Technologies

- Square

- PayPal

- MicroStrategy

BLOK has an expense ratio of 0.70% and has a grade of B from FactSet.

Webull as an Alternative to Fidelity

If neither the new Bitcoin Fund nor the blockchain ETFs appeal to you, you could instead open an

account at a rival brokerage firm and trade cryptocurrencies directly.

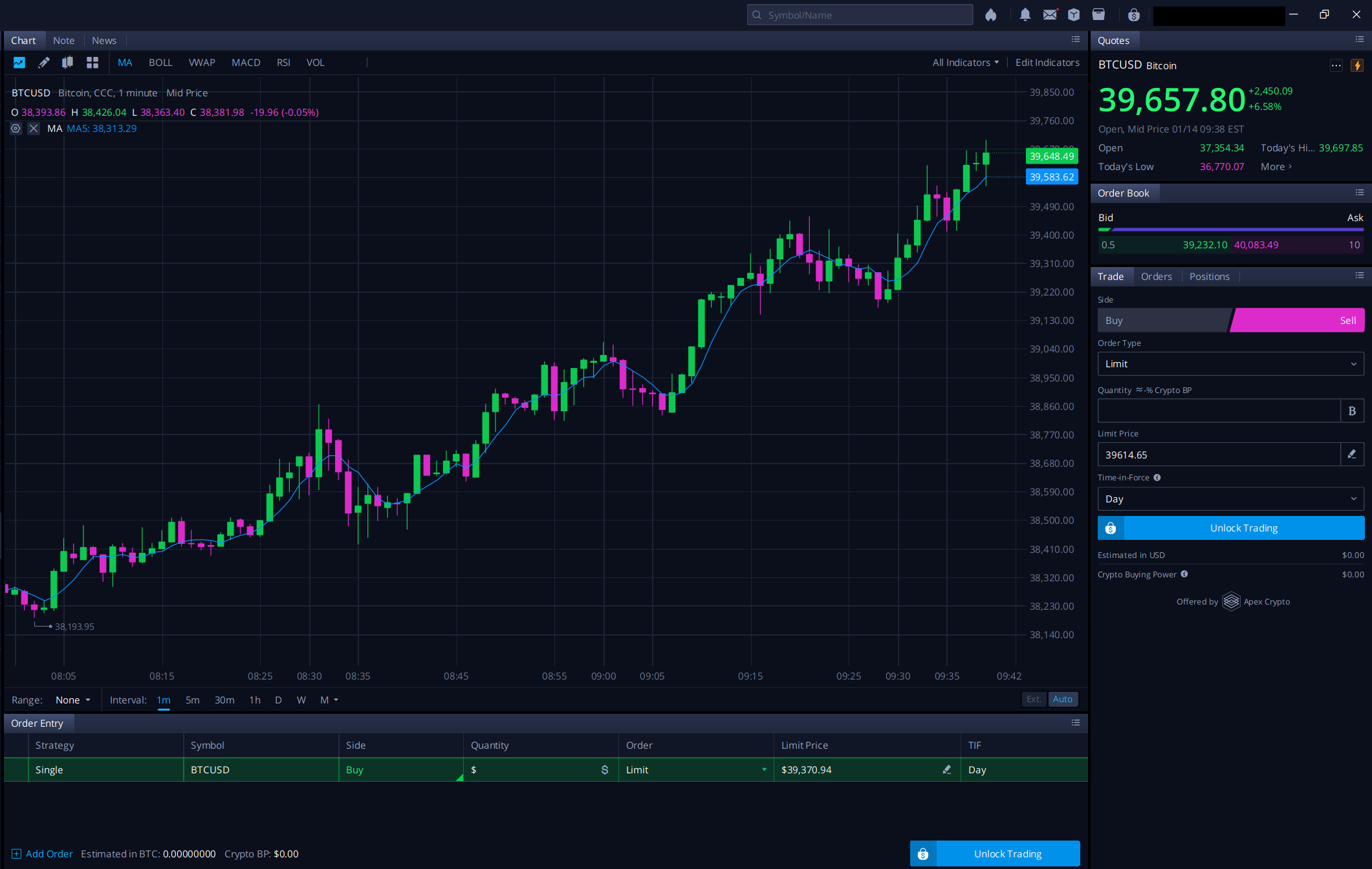

Webull is one broker that offers trading in cryptocurrencies.

During our investigation, we were able to trade cryptos on all of Webull’s software platforms. These include its desktop program, mobile app, and browser platform. Even better, we didn’t have to pay anything to trade these digital assets because Webull’s commission is $0.

Currently, there are available cryptocurrencies at Webull:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Litecoin

- Dogecoin

- Dash

- Stellar

- Zcash

To place a trade, you’ll need at least $1 in available cash because that’s the broker’s minimum investment in digital currencies.

Cryptocurrency trading on Webull’s mobile app comes with some really nice features, including a digital message board where traders can discuss the pros and cons of a particular currency. On the day we did our research, we found hundreds of posts on the Litecoin profile going back just a few days.

For actual trading, Webull provides a coin’s bid-ask spread on all three platforms. The trade

price shown is actually the middle point between these two numbers and is not a real trade price.

Trades can be placed either in dollar or coin amount. It is not possible to short

sell cryptocurrencies at Webull.

Learn more...

Webull Promotion

Open WeBull Account

Cryptocurrencies vs. Blockchain Funds

Trading spot cryptocurrencies comes with advantages and disadvantages compared to the blockchain ETFs. First is the fact that trading one cryptocurrency is an investment in a single asset, while the blockchain ETFs hold several assets. This means that the funds will be less volatile than a single cryptocurrency.

Second, cryptocurrencies at Webull are available for trading 24 hours a day, 7 days a week (with a one hour break each day at 5:30 pm, EST).

Third, trade settlement on cryptocurrency transactions takes place immediately. For blockchain ETFs, settlement is two business days (T+2).

Is Fidelity Good Company for Long-Term Investors?

The price of trading isn't that important to buy-and-hold investors because they don't trade that often anyway. They will instead want to see better customer service and financial planning resources. Fidelity certainly has both. The broker offers 24/7 customer service over the phone and through on-line chat. There are more than 180 Fidelity locations throughout the U.S. Fidelity associates have a history of being well trained, too.

Many financial services are also available from the broker, including free stock reports and portfolio

management services. Several other brokers, including Firstrade and Vanguard, don't have the same level of

investment services. Despite all of Fidelity's amenities, the broker manages to charge a low $0 commission.

Schwab, by comparison, charges $0, and TD Ameritrade customers pay $0.

Mutual funds are popular with long-term traders, and Fidelity has a good selection of them. The broker's fund screener generates 11,500 products. Of these, roughly 1,800 have neither load nor transaction fee. Merrill Edge has more no-load, no-transaction-fee funds, while Capital One Investing has fewer.

Fidelity performs fairly well here.

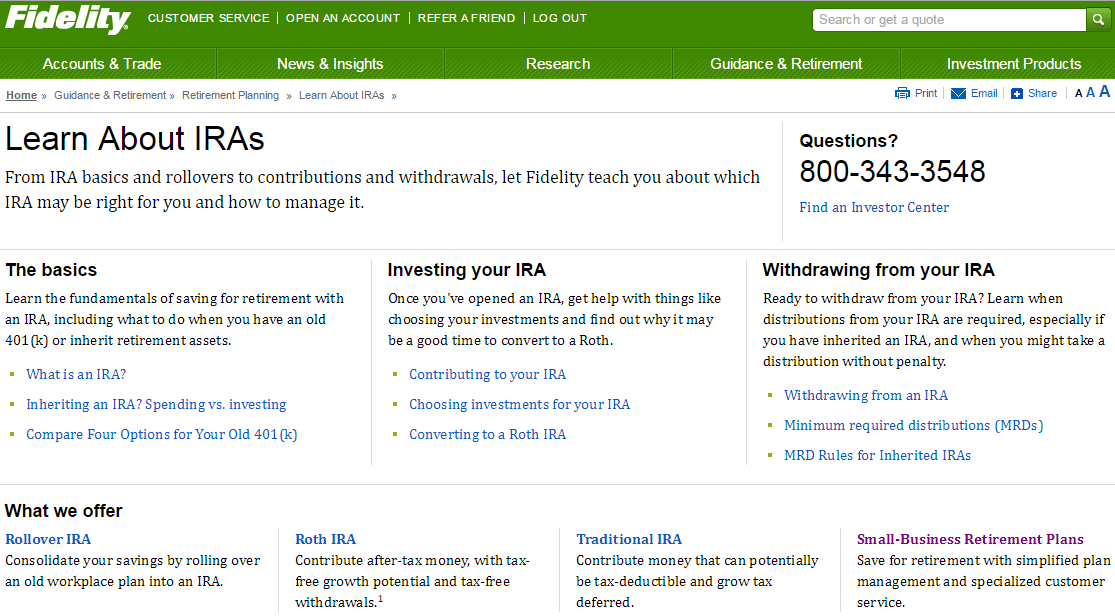

Is Fidelity Good Company for IRA's?

Retirement savers can open several different IRA types at Fidelity, including Traditional, Roth, SEP, SIMPLE, Rollover, Inherited, and Minor Roth varieties. There are ten IRA's at E*Trade, while Firstrade customers can choose from just five.

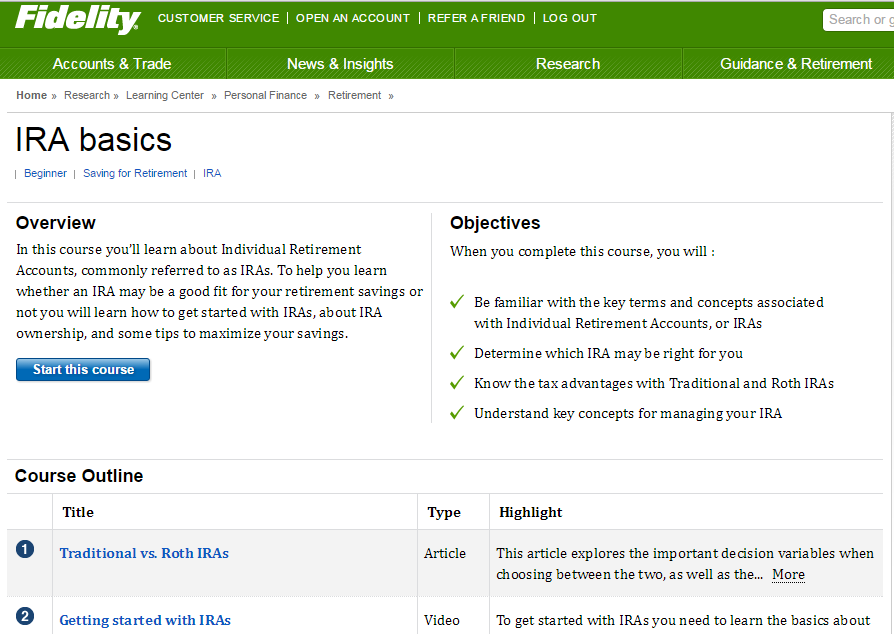

There is a lot of information on Fidelity's website devoted to retirement issues. Articles, videos, and self-guided courses cover topics such as creating a retirement plan and securing a stream of income. The broker also has several IRA calculators, including one that determines the amount of money that must withdrawn from a Traditional account per year under IRS guidelines.

A Fidelity IRA comes with no annual, low-balance, or maintenance fees. However, the broker does impose a $50 charge for closing an IRA. Some other brokers, such as TD Ameritrade, don't charge a fee to close a retirement account. On the other hand, E*Trade IRA's carry several fees, while an Interactive Brokers IRA comes with a $7.50 quarterly fee. Fidelity doesn't require a minimum deposit to open a retirement account. Schwab, by comparison, requires $1,000 to open an IRA.

Fidelity does pretty well here.

Is Fidelity Good Firm for Beginners?

Beginning traders can benefit from a good supply of learning materials. The Fidelity website has an excellent selection of resources on a section called Learning Center. Here, investors will find a very large assortment of articles, videos, infographics, and courses on a wide range of topics. These include technical analysis, trading in options, and bond investing. There are also materials on issues beyond the world of securities, including college planning, commodities, and charitable giving. Fidelity's educational resources can be sorted by experience level, one option of which is beginner. Fidelity also operates live on-line webinars. An upcoming one discusses how to write covered calls. Older webinars are archived on Fidelity's website. Most other brokers, including OptionsHouse and WellsTrade, don't have nearly as much learning material.

Unfortunately, Fidelity does not offer paper trading. This would allow new investors the opportunity to practice trading before committing real money. TD Ameritrade and optionsXpress do offer this useful feature. On the other hand, Fidelity provides 84 ETF's that can be traded free of charge. This would be an opportunity for new investors to practice trading without paying commissions. Scottrade, by comparison, doesn't have any commission-free ETF's.

Fidelity seems adequate here.

Is Fidelity a Good Choice for Active Traders and Shorting Stocks?

Frequent traders especially need a low trading commission and a good platform. Fidelity's $0 charge for

stock and ETF trades. Fidelity's additional charge of 65¢ for derivative contracts is the industry norm.

Tradestation is lower at 50¢.

Fidelity does offer an advanced trading platform called Active Trader Pro. It comes with pretty steep requirements, though. At least 36 trades must be placed per year in order to access the software. This is a stricter requirement than Schwab, who only requires a $1,000 account balance. Merrill Edge requires 60 trades per year to use its trading software. TD Ameritrade is one of the few brokers to offer a sophisticated platform with no strings attached.

Shorting stocks requires margin, and Fidelity has competitive margin rates. A loan under $10,000 right now costs 8.825%. Currently, Capital One Investing customers pay 8.2%, and WellsTrade charges 9.5%.

Recap

Fidelity is a good overall value in financial services. The broker also does well in specific areas, especially those that require customer service options and educational resources.

|