Cryptocurrency Trading at eToro

Although eToro is mostly famous for its copy trading service, it also offers the ability to place your own cryptocurrency trades. If the Bitcoin frenzy has you interested, eToro may be worth checking out.

Available Coins

eToro accounts based in the United States can trade 14 digital currencies. A few states are not yet eligible. These locations include New York, Nevada, Tennessee, and a few others.

The list of coins includes the most popular ones. Here’s a sampling:

- Bitcoin

- Bitcoin Cash

- Ethereum

- Ethereum Classic

- Stellar

- Cardano

- Tron

Missing on the list is Ripple.

Crypto Crosses

Besides individual coins based in U.S. dollars, eToro also presents cryptocurrency crosses. These are coins priced in other coins. For example, instead of BTC/USD, which is the amount in U.S. dollars that one Bitcoin trades at, you might see BTC/EOS, which is the amount of the EOS cryptocurrency per Bitcoin. On the day we did our research, BTC/EOS was trading at 13,949.

Cryptocurrency crosses cannot be traded on the eToro platform.

Crypto Copying

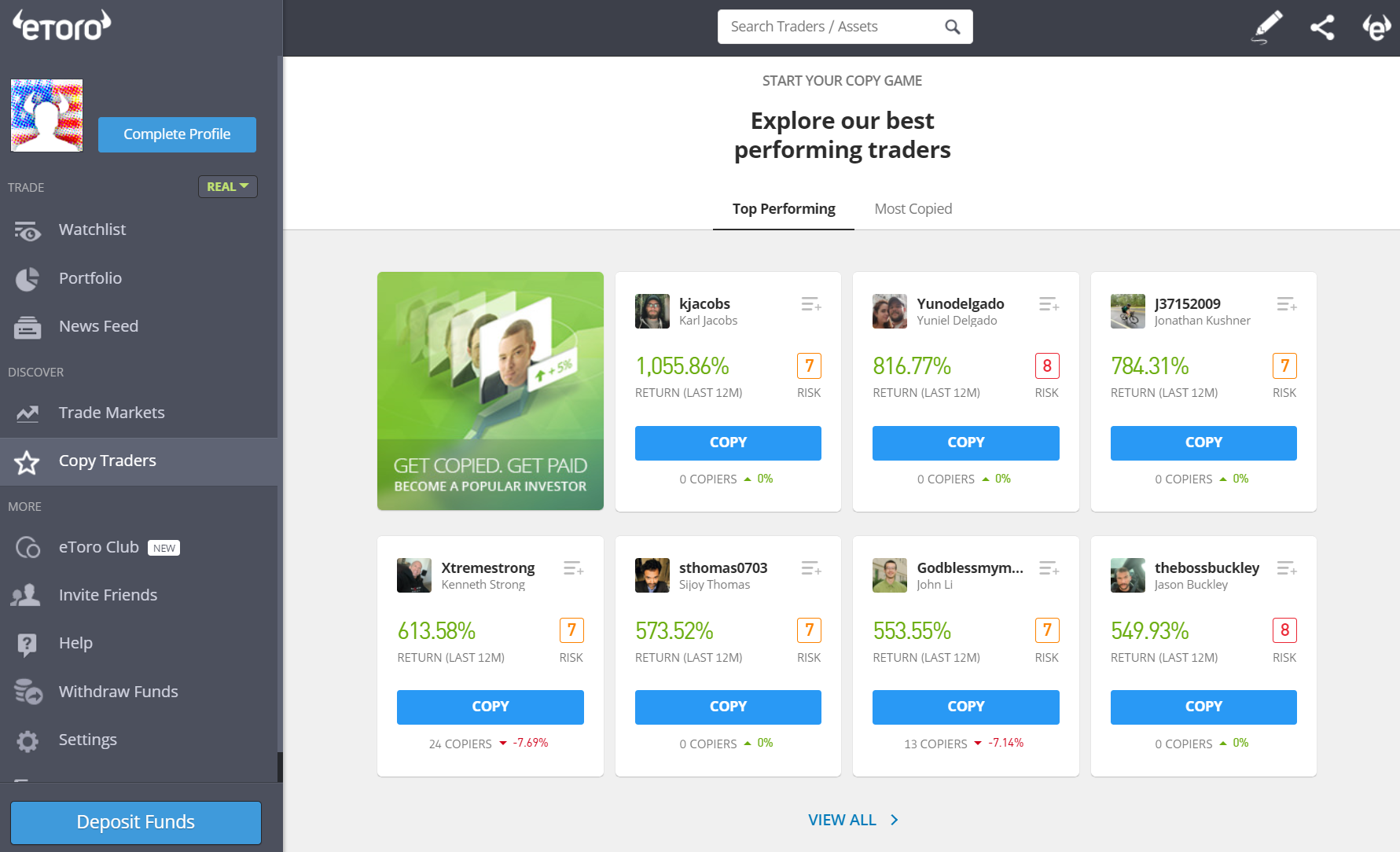

If you’re not sure what you should be trading, eToro has a solution for you: crypto copying. This is a service that allows users to copy the trades that other eToro customers are making.

Just click on the Copy Traders link in the left-hand menu to get started. You’ll see a list of

other eToro traders with their 12-month returns. The eToro platform provides information on their backgrounds along with risk scores regarding how volatile the portfolios are. Perhaps most importantly, the eToro platform provides exact holdings and their percent amounts, so you know exactly what you would be investing in before making a choice.

Besides trailing twelve-month performance, eToro also provides return information on every month the portfolio has been on the broker’s platform along with the portfolio’s risk score in the month. This can and does vary.

Other details include:

- Total number of copiers

- Number of copiers in the past seven days

- Total number of trades the portfolio has made

- Average trades per week

- Average hold time

A $1,000 minimum investment amount is required to copy a trader. You can set a trigger that will take you out of the copy trade. By default, it is $600, although this number can be changed.

eToro clients who are copied are paid by the broker. They are called Popular Investors on the platform, and there are various requirements to become a Popular Investor.

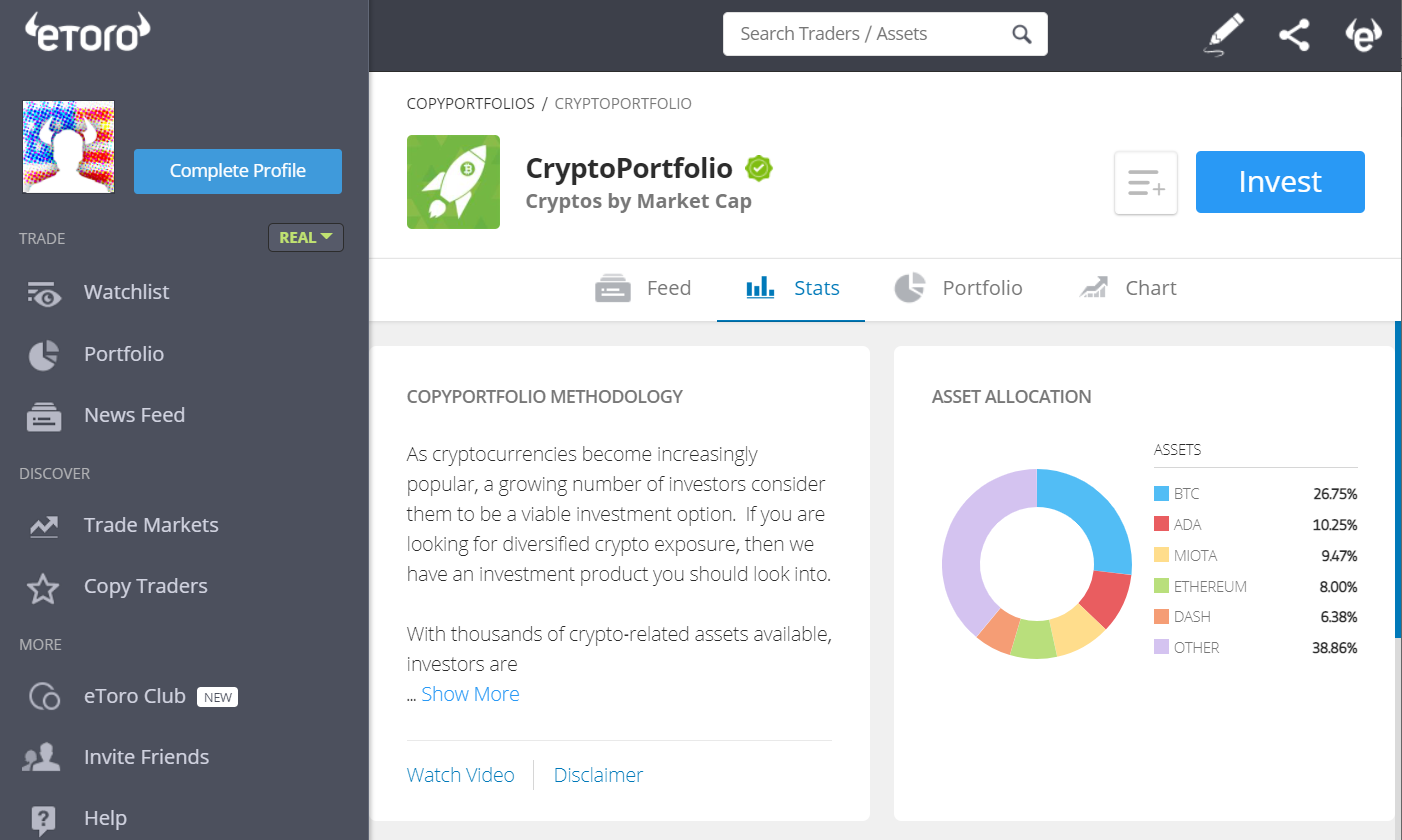

CopyPortfolios

If you don’t care for the portfolios of other eToro customers, you could opt for CopyPortfolios. These are ready-made portfolios built by eToro itself. Each one has a predetermined strategy and is rebalanced regularly. The minimum investment is a little higher (anywhere from $2,000 to $5,000, depending on the specific portfolio).

Examples of CopyPortfolios include:

TheTIE-LongOnly: This one is built by a software program that analyzes hundreds of millions of daily tweets for crypto sentiment. The algorithm then weights the crypto holdings on the sentiment gauged. The portfolio is rebalanced monthly and automatically.

CryptoPortfolio: To make it into this basket, a cryptocurrency must have daily trading volume of at least $20 million and a market cap over $1 billion. The minimum target weight of an individual coin is 5%, and weights are proportional to the coins’ market caps.

Top Cryptocurrencies: This one holds just two digital assets: Ethereum and Bitcoin. Because it is based on market cap, Bitcoin is the larger holding (87% at the time of publication). The fund has more than $5 million in assets. Its worst month experienced a decline of 17%, while its best month saw an increase of 43%. The fund has over 2,700 investors.

Fees and Commissions

And what does all of this cost? Surprisingly little. eToro charges no commissions on trades in either self-directed or copy investing. It does make money off of bid-ask spreads, which can be as high as 5% in some cases. There are also no management fees of any kind in the available portfolios on the eToro platform.

eToro has eliminated withdrawal fees for U.S. clients. However, it does have a $30 minimum withdrawal amount. Although the broker does not charge any fees for sending or receiving currencies, there could be blockchain fees.

When converting from one digital currency to another, eToro charges a conversion fee of 0.1%.

eToro does not have an annual account fee. A $10 inactivity fee is not assessed against U.S.-based accounts. The broker requires a $50 deposit to start trading, although no deposit is required to create a login.

eToro Club

eToro has a new service that crypto traders with at least $5,000 in assets can take advantage of at no cost. The program comes with many benefits, although most of these perks are reserved for higher tier levels (the highest is the Diamond level, which requires $250,000 in assets).

The bottom rung is the Silver tier, which requires just $5,000 in assets. Silver customers get a market newsletter and access to live streaming webinars. The Platinum tier starts at $25,000 and delivers free trading signals, priority customer service, and a free subscription to The Wall Street Journal.

Software

To manage all of these services and place trades, eToro has a simple but effective website. The brokerage house does not have a desktop platform, and the tools on the website are pretty basic; but they do get the job done.

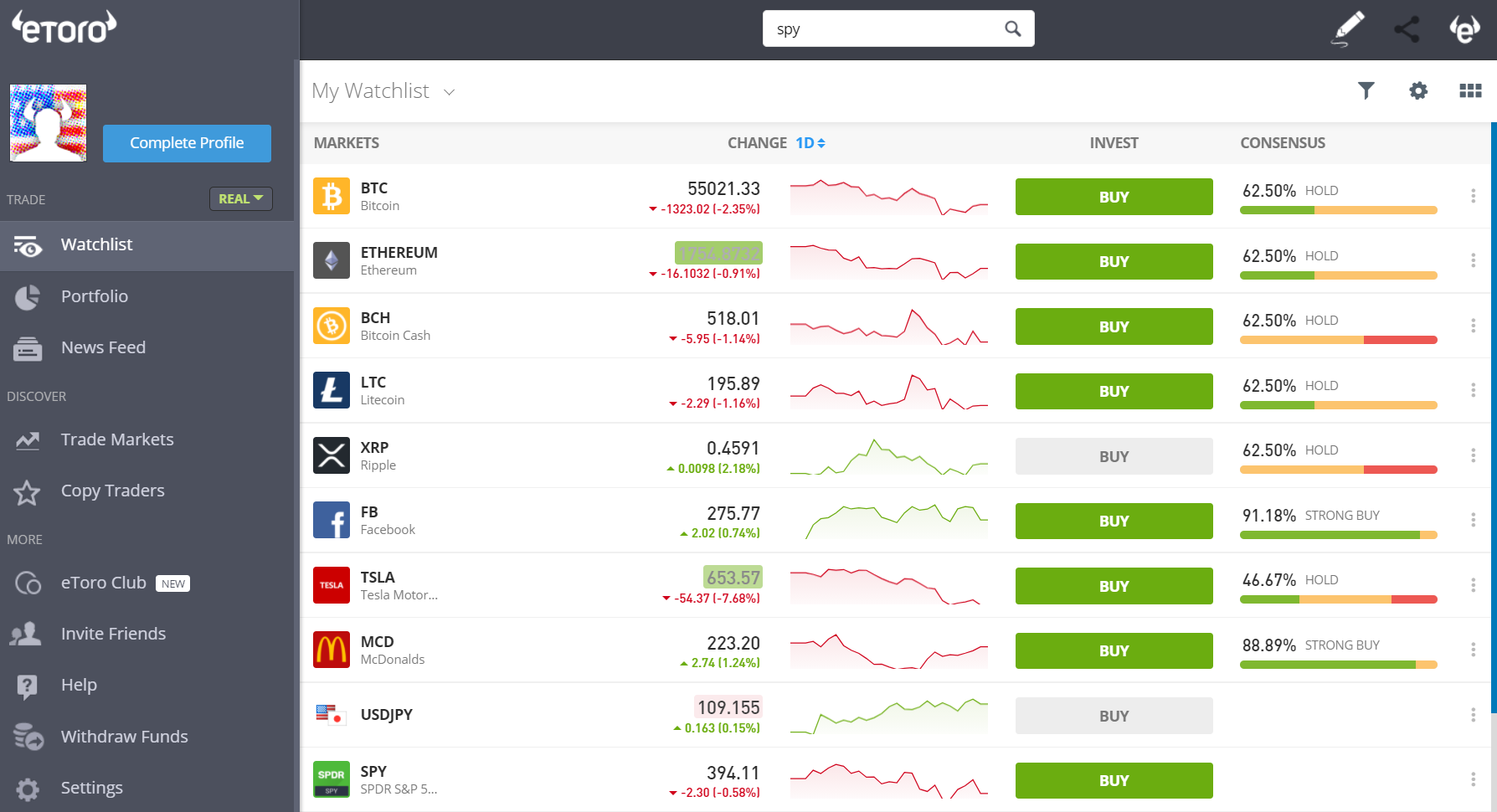

At the top of the left-hand menu, there is a Watchlist link. As the name implies, this is where you’ll find the default watchlist. It’s possible to create your own and set one as the default. The holdings can be arranged as tiles or as a list.

The News Feed link isn’t really a news feed. Instead, it’s a list of posts by eToro members. It’s possible to follow other users on the platform (including their investment gains and losses), look at what they’ve been buying and selling, and comment on their posts.

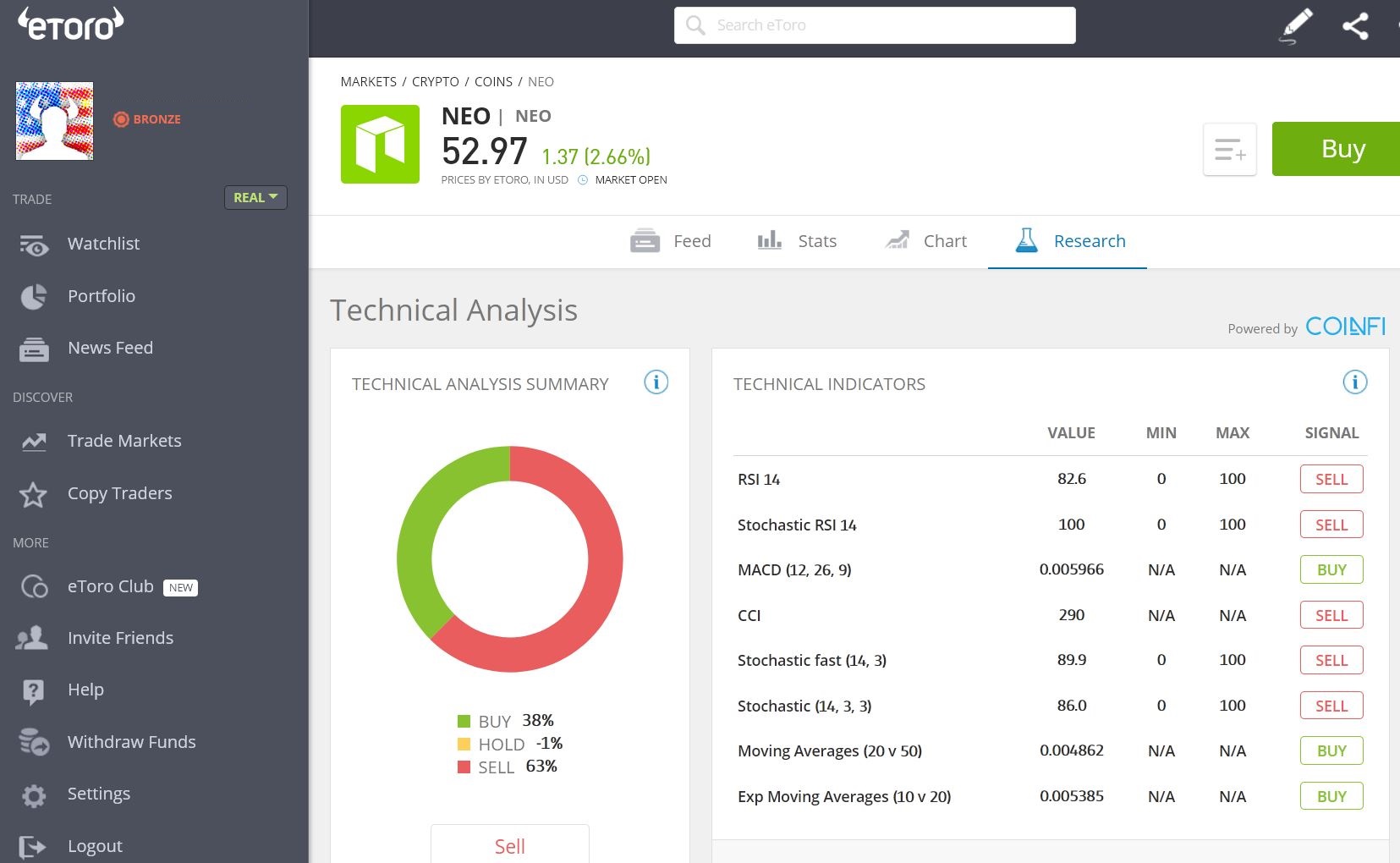

A coin’s profile has its own news feed, and this is a great way to communicate with other eToro clients about the pros and cons of an asset. Other features include a chart, coin overview, vital stats, and research tools.

Charting can be accomplished nearly full screen. eToro’s software has multiple display styles and numerous technical studies. Comparisons can also be made.

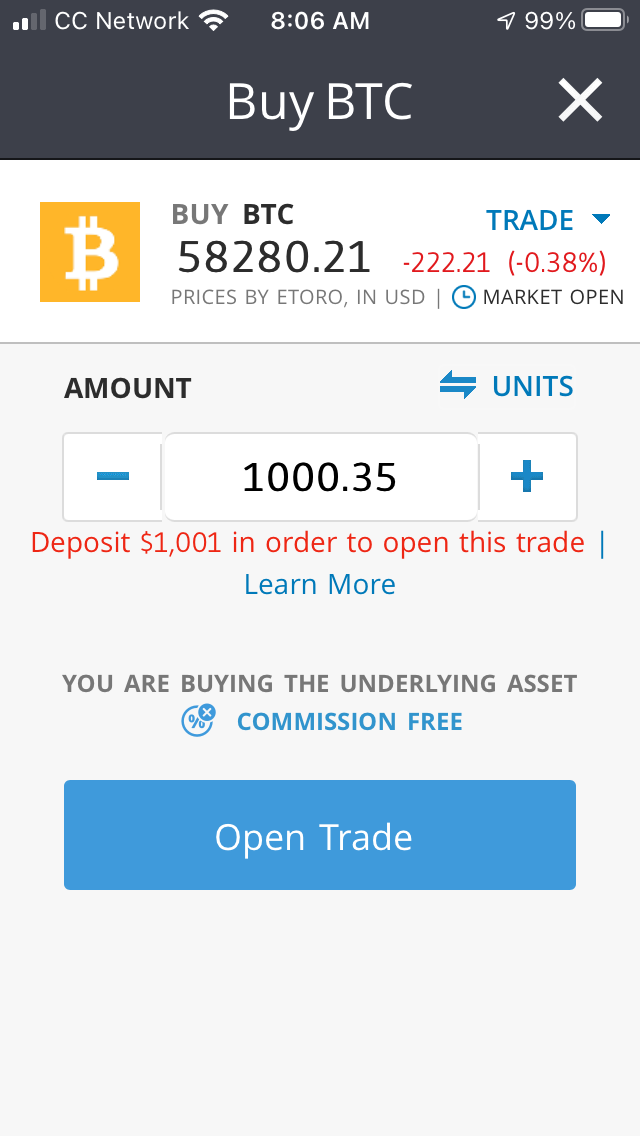

A green buy button appears on a coin’s profile (it also appears on each coin’s tile on the watchlist). Clicking on the button will bring up the order ticket. It has two trade types: order and trade. The latter is a regular market order, while the former uses a trigger to submit an order when the price level is reached. In either case, a dollar amount or coin amount can be used to specify the quantity.

Although stocks, ETFs, and currencies can be added to a watchlist, American customers cannot place trades for them. These investment vehicles do have profiles, so it’s always possible to research and discuss them.

And then there’s the mobile app. Compatible with both Apple and Android phones (and tablets), it has the same features mentioned above in mobile format.

Transferring Coins

eToro does permit transferring coins out of an account to an external wallet. There are two steps involved:

1. Transfer coins to the eToro wallet,

2. Transfer coins from the eToro wallet to an external wallet.

Unfortunately, it’s not possible to go in the other direction.

Competitors

As an alternative, you can use a

a U.S. brokerage firm called Zackstrade that also offers crypto currencies trading.

Zackstrade Promotion

Open ZacksTrade Account

Judgment

eToro has an excellent cryptocurrency trading service that meets or exceeds everything else out there.

|