Wells Fargo Crypto-currency Trading

Investors who are looking to trade popular cryptocurrencies, such as BAT, Bitcoin, Bitcoin Cash,

Cardano, Dogecoin, Ethereum, Litecoin, Shiba Inu, NEO, Ripple, Stellar, cannot do it on

Wells Fargo. The broker simply does not offer them. For Ethereum, Bitcoin, Bitcoin Cash, Litecoin, Dash, Zcash, Stellar,

Dogecoin, and many more coins trading, investors can use a

$0-fee Webull.

Webull Promotion

Open WeBull Account

Wells Fargo Advisors Overview

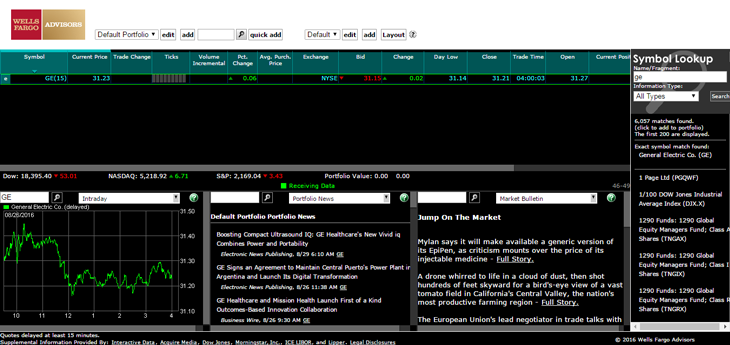

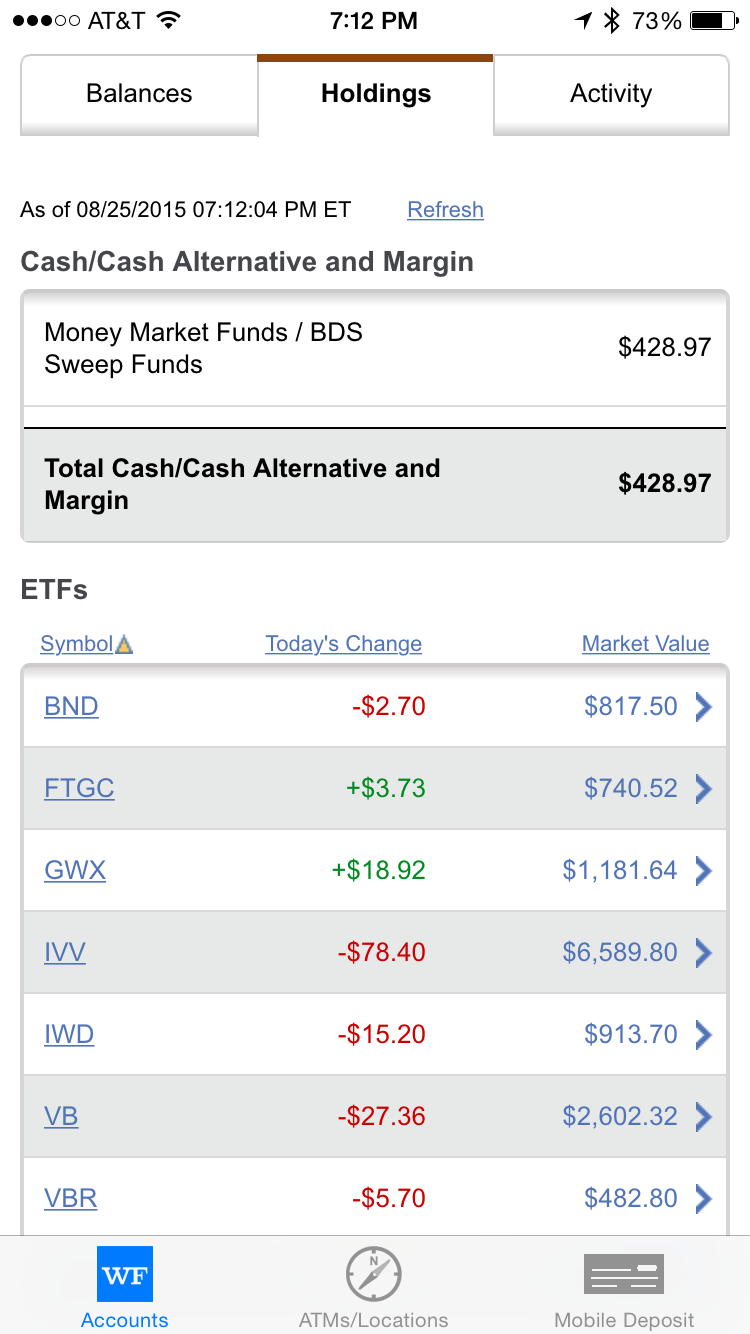

Investors at WellsTrade can buy and sell funds inside an IRA using the broker's trading technology. Let's take a look at all three and see how they compare to some

of the firm's competitors.

Wells Fargo Advisors website is a decent first step for monitoring account balances, trade activity and other transactions, and requesting account services such as beneficiary designations or updating contact information.

The website contains links to basic research on stocks, bonds, and mutual funds; education on retirement planning, features of the different IRAs available in the market, and managing your portfolio; and other services such as performance monitoring and accessing statements and other documents.

One salient feature is a tool called “My Retirement Plan,” a savings calculator that is simple and easy to use. It’s similar to other retirement planning calculators where the projections are based on current best guesses, but it makes a good starting point for individuals to think about saving for retirement.

There are three other useful calculators with regard to IRA accounts. The Annuity Calculator shows the effect of tax-deferred compounding on annuity investment growth potential. The IRA Calculator helps you determine how much money you are allowed to contribute to IRAs in the current tax year. The Retirement Planning Calculator computes how much money you’ll need to invest to reach your retirement goals. All are simple and straightforward and designed to help individuals better understand and take control of their retirement planning.

Pros of a Wells Fargo Advisors IRA Account

- Personalized full service from a licensed and trained financial advisor

- The backing of one of the largest financial institutions in the country

- Competitive commissions on stock and bond trades

- Comprehensive investment and account options

- A wide selection of helpful tools to assist in saving, planning, and investing for retirement

Cons of a Wells Fargo Advisors IRA Account

- Wellstrade margin rates are high

- Annual fees and other administrative costs can reduce overall investment returns

- Website isn’t user-friendly and seems overly complicated and vague

- Investment alternatives may focus primarily on Wells Fargo products to the exclusion of other qualified investment options

Summary

In summary, despite of annual fee, which will scare away some clients, a Wells Fargo Advisors IRA is a good option for unsophisticated investors

who either don’t understand investing and financial topics, or don’t have the time to manage their IRA portfolio and want the assistance and guidance

of a financial advisor to help them achieve their financial goals.

|