Review of the Uniswap Trading Platform

You may have heard of decentralized finance or DeFi for short. It's an exciting new way to invest that is decentralized, meaning you can trade with other investors without the need of a middleman. There are many different platforms out there to choose from, and they all work in different ways, but one worth looking at is The UniSwap DeFi Trading Platform. This article will give you more information on what it does and how it works.

What is Uniswap?

Uniswap is an automated trading platform that lets you trade Ethereum for ERC20 tokens. It allows you to choose your own price, and it will automatically match trades when the conditions are met. This platform is optimized for speed and security, so when using the UniSwap DeFi Trading Platform, you can be confident of a quick, easy, and safe trade.

For most conventional users, the platform is useful for trading or investing by providing liquidity for traders. This system is similar to other DeFI (Decentralized Finance) DEXs (DeFI Exchange), like Balancer, Cakeswap, etc.

How does it work?

UniSwap uses automated market makers that set the prices of crypto currencies based on what people are willing to pay or sell for. It is decentralized, meaning that it can not be stopped or taken down by anyone at any time. Although it will always be running, the platform itself doesn't require any energy, so it doesn't have any of the expenses that other similar sites have.

With UniSwap DeFi Trading Platform you can trade with anyone worldwide without paying commission fees, which means more profit for you. This platform is beneficial to users looking for new ways to make money in this constantly evolving market.

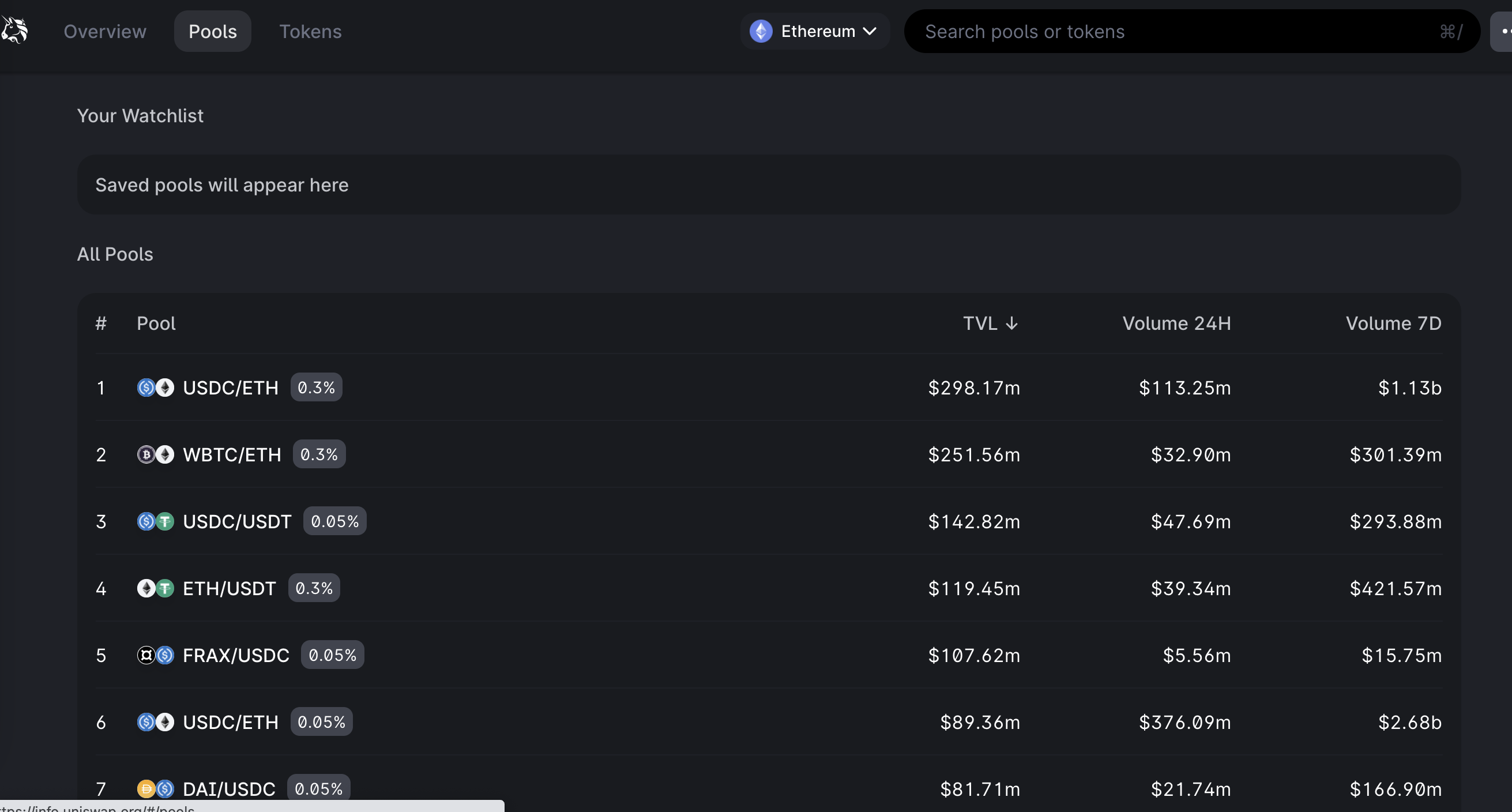

The platform allows users to choose a range of prices for coin pairs to provide liquidity for liquidity investors. Once users provide liquidity, they will earn returns on liquidity mining and swap fees. Essentially investors provide a pool that traders use to capitalize on changes in currency values. For every trade from a pool, the investors that provided liquidity will earn a swap fee.

The earnings for investors will depend on both the volume of trades for the coin pair and the swap fee. More volatile coins will earn a higher swap fee, but investors risk holding volatile coins over the long term. This is the classic risk/reward each investor must weigh for themselves.

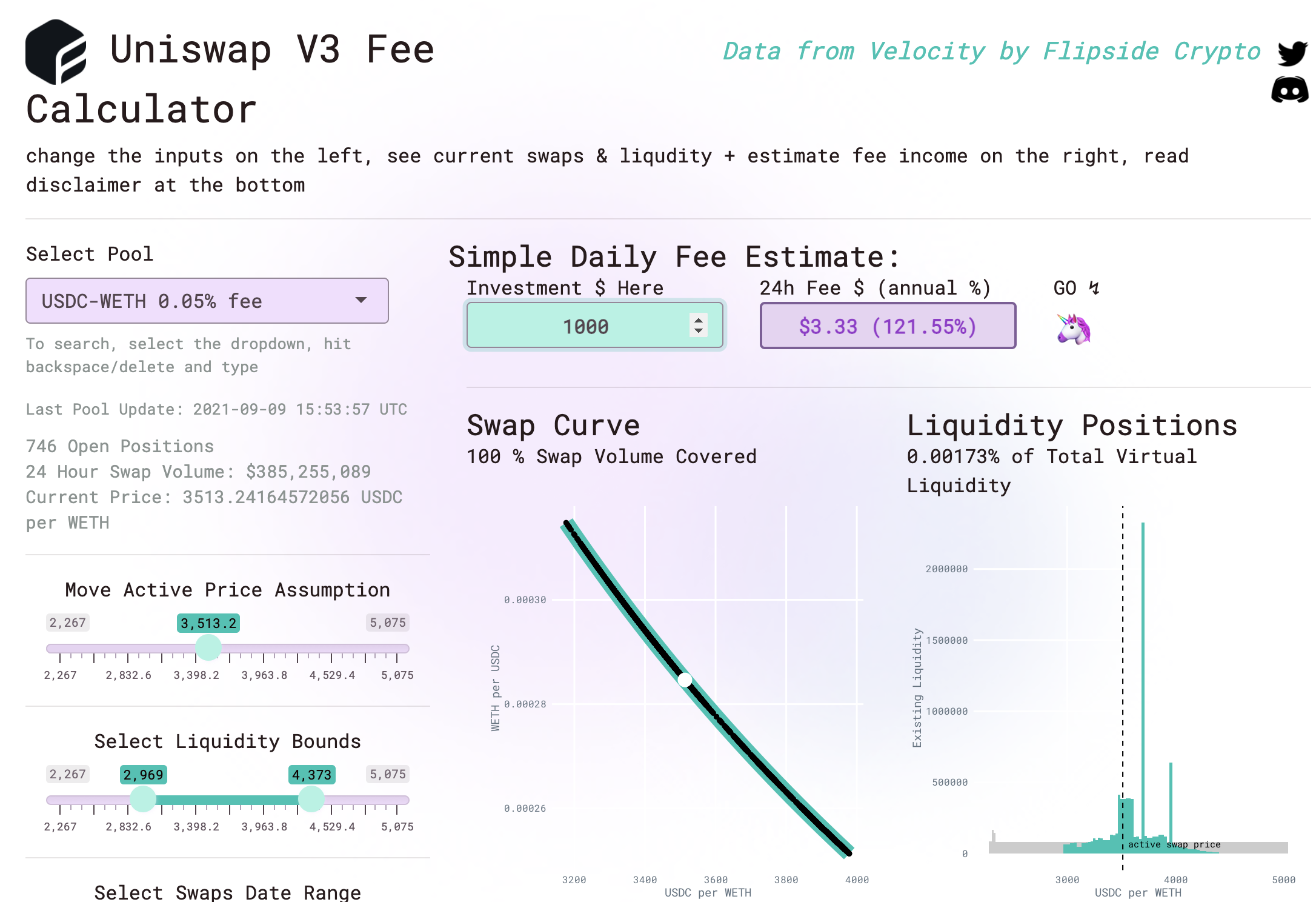

Flipside offers a helpful calculator for investors.

On this calculator, you can run different scenarios that show how much an investor can earn if the market behaves in a certain way.

In this example, an investor that provides liquidity to a USDC-WETH pool, has the potential to earn 121.55% per year if the market behaves according to the conditions present in that example.

Why should I use it over other decentralized exchanges

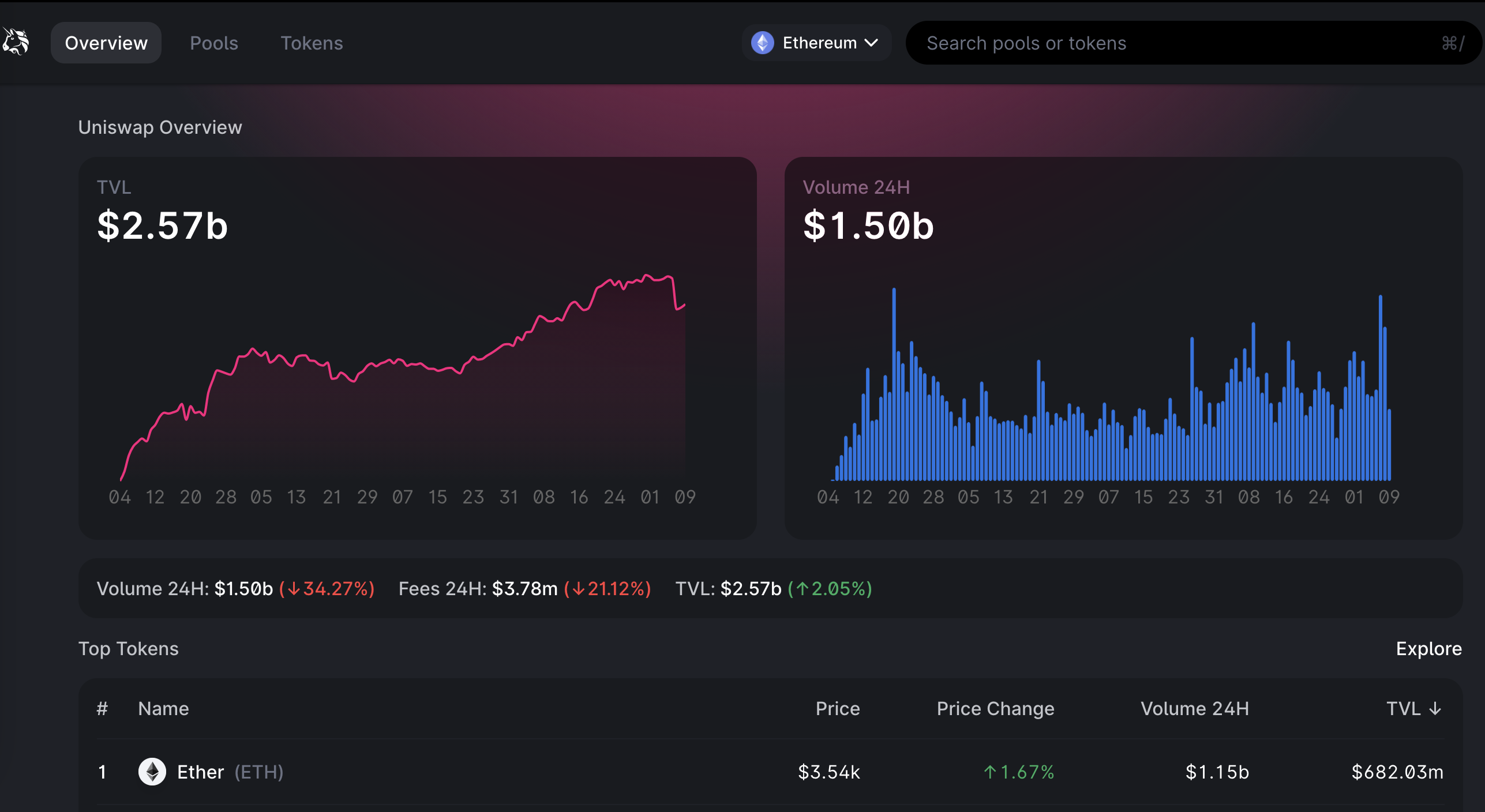

Uniswap is one of the first DEXs, and it also currently has one of the highest trade volumes among all DEXs. A high trade volume is good for investors because it means it carries more potential to earn returns on swap fees.

One of the main reasons Uniswap is so successful, especially compared to other similar DEXs like Cakeswap and Balancer, is that it's fast. Uniswap can process more than 1 million transactions per second (TPS), making it one of the fastest decentralized exchanges out there.

What does this mean for investors? With Uniswap, you can expect to earn much higher returns on liquidity mining because it has a larger pool of traders to purchase coins from.

How do I get started?

To get started with UniSwap, you must change your browser settings to enable MetaMask, Coinbase Wallet, TrustWallet, or others. Once you've enabled your wallet, all you have to do is deposit tokens into your wallet and wait for the liquidity pool to fill up. Then you can start trading!

Pros and cons of the platform

The platform is high-speed and provides an interface that is easy to use.

Uniswap Pros:

- Fast transactions, even at high TPS.

- Easy to start using the site with only a wallet enabled.

- Solid customer service for any questions you might have.

- High trade volumes mean higher potential returns for investors.

Uniswap Cons:

- Like all DeFi platforms, it can be hacked if.

- The balancing algorithm can cause an impermanent loss of the currencies that are being swapped.

- Gas fees can be high on the Etherum block chain at times.

- Because of Gas fees, investors must be sure to invest enough funds to cover the frictional costs.

- As with other DEXs, transactions can fail at times due to insufficient gas fees.

Is there a fee for using the platform

Uniswap does not charge a fee for using the platform, and instead uses a system of swap fees. Whenever you make an exchange on Uniswap, you will pay a small amount to cover the cost of gas used by the Ethereum blockchain to process your transaction. This is often referred to as "gas". The more swaps you make in one day, the more charges add up. However, if your earnings from liquidity mining are greater than this, then it will be beneficial for investors overall.

Uniswap Review Recap

If you’re like many people in the crypto world, your investment portfolio is diversified. This

means that if one exchange has problems or gets hacked, it won’t be a total loss of all your

assets. Uniswap offers this same type of convenience for users who want to trade multiple

cryptocurrencies on decentralized exchanges without having to sign up with each platform.

The pros

and cons section outlines what makes Uniswap different from other DEXs out there, so whether you

are an experienced trader or just getting started investing in cryptocurrency, we hope that our

information helps guide you towards making the right decision about which trading platform will

work best for you!

Webull Promotion

Open WeBull Account

|