Review of the Balancer Trading Platform

Balancer is a DeFi platform that uses smart contracts to create tokens to provide liquidity to investors. Investors can buy and sell these tokenized securities on Balancer's trading platform, which offers benefits such as no listing fees, speedy settlement times, and lower transaction costs than traditional exchanges. This review will evaluate Balancer's features in detail so you can decide if they are suitable for your investment needs.

What is a Balancer DeFi Trading Platform and What Does it Do?

Balancer is part of a newish breed of DeFi (Decentralized Finance) protocols that grant traders and investors faster and easier access to crypto markets.

The platform serves two main groups of people. First, it serves investors looking to create "index funds" with different crypto assets. It also serves traders looking for faster and easier trades with crypto.

For investors - Balancer states, "Balancer turns the concept of an index fund on its head: instead

of paying fees to portfolio managers to rebalance your portfolio, you collect fees from traders

who rebalance your portfolio by following arbitrage opportunities."

Essentially, it allows investors to hold pools of different crypto currencies and tokens that, in turn, distribute risks.

For traders - Balancer states, "Balancer enables efficient trading by pooling crowdsourced liquidity from investor portfolios and using its Smart Order Router to find traders the best available price. Exchange any combination of ERC-20 tokens permissionlessly, with ease." Essentially, traders can trade any ERC-20 token without barriers.

The Benefits of Using the Balancer DeFi Trading Platform

The most important benefit of using Balancers' platform is the potential to eliminate middlemen by transferring ownership through digitization of assets.

Transactions are also faster because they happen automatically once conditions have been met without human intervention, saving time and increasing efficiency. Additionally, there are no listing fees or commissions charged for using Balancer's trading platform which helps investors save money by transferring ownership of value in a trustless manner without intermediaries.

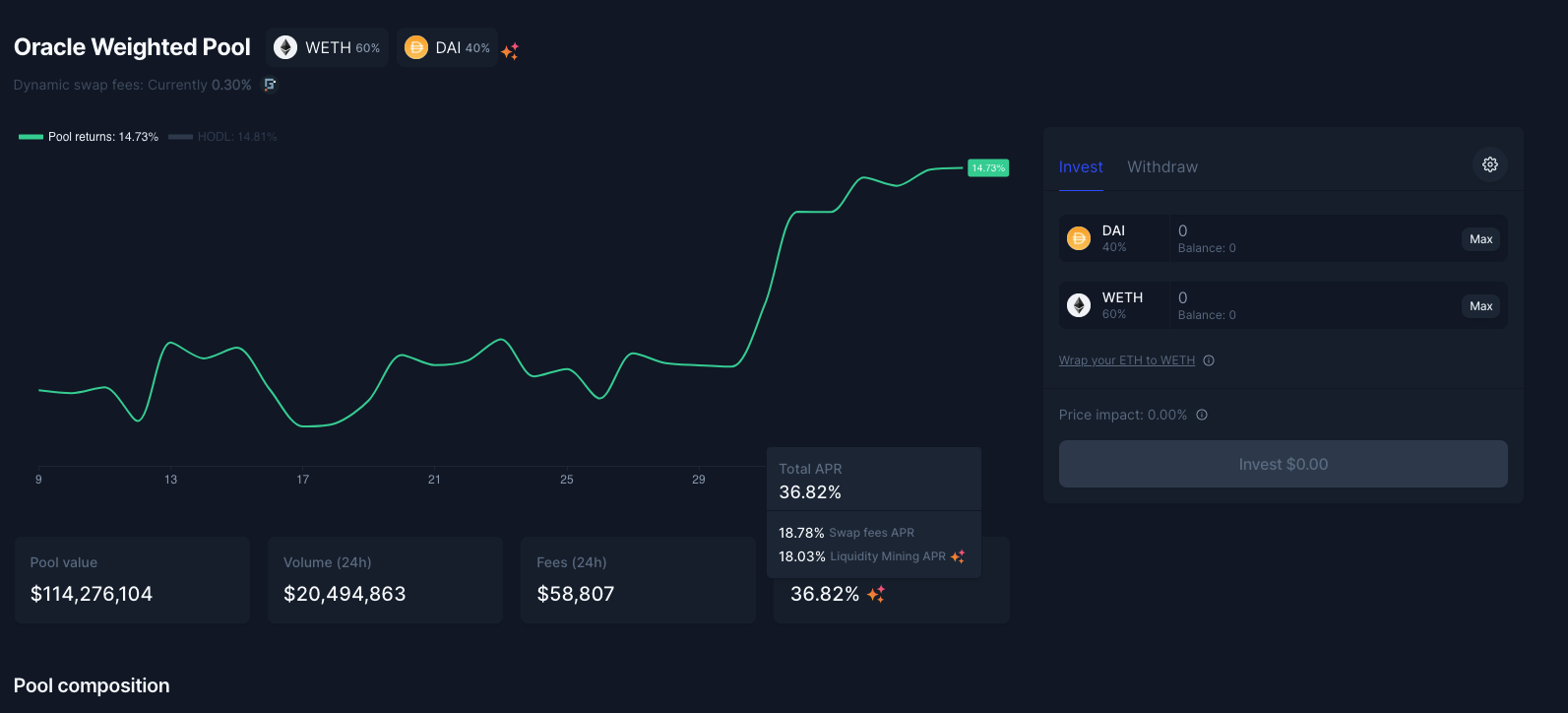

For investors, there are two great features. First, it helps distribute risk away from one single crypto asset by pooling your asset with other assets. Secondly, it allows investors to earn passive returns in three main ways:

- Underlying asset appreciation

- Earn swap fees from traders

- Earn balancer tokens form liquidity mining

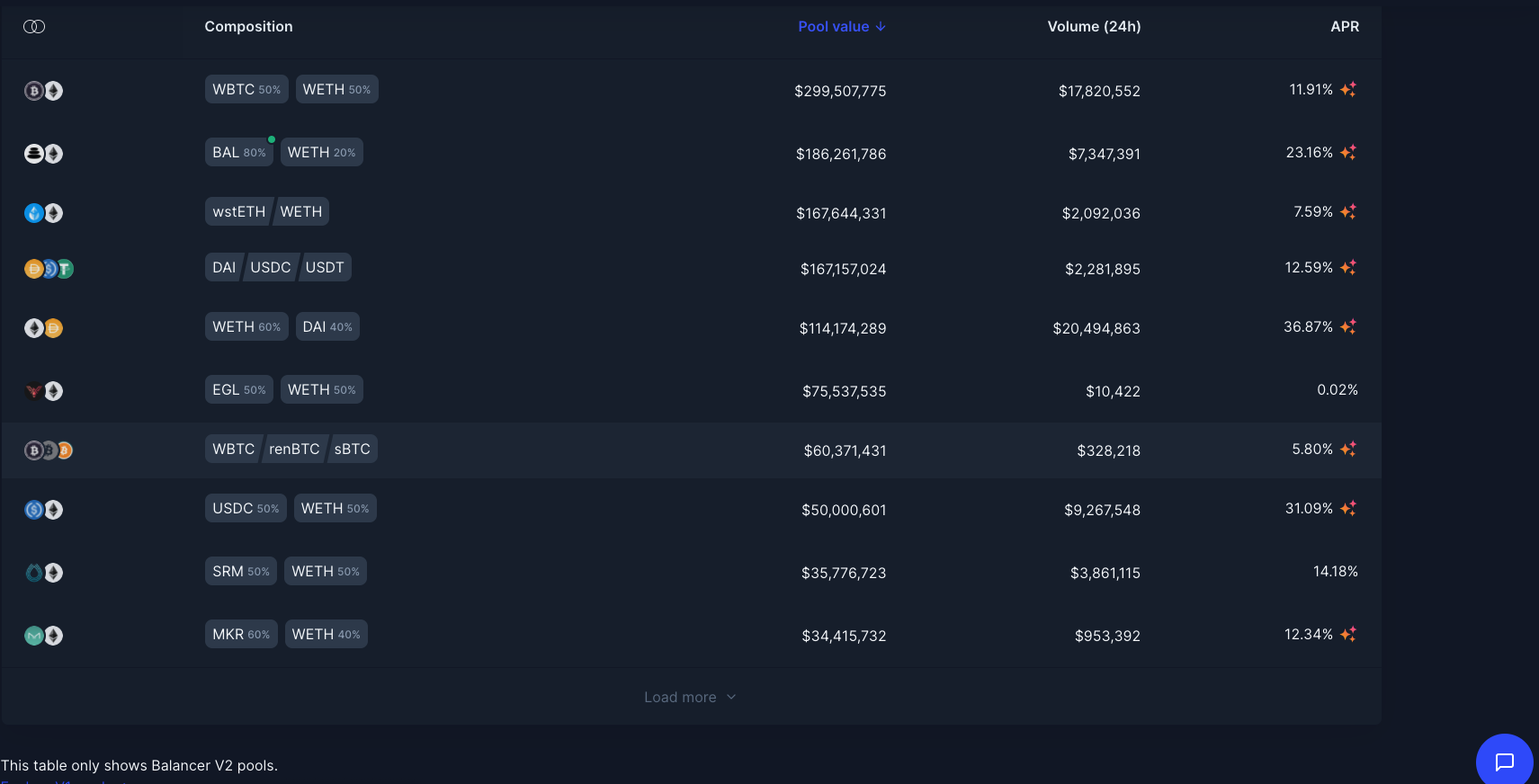

At the time of this writing, some pools with more volatile tokens can bring in 30% returns. Other pools with more standard/stable tokens still can bring respectable 8-15% returns (not counting asset appreciation).

How to Use the Balancer DeFi Trading Platform

Balancer has made using the platform very easy. In fact, compared to most other platforms, it has a very straightforward and seamless entry to the platform.

Simply go to app.balancer.fi and

connect your wallet (Uphold or Metamask). Once the wallet is connected, you will have options to invest or trade. To invest, simply find the pool that meets your criteria and click on "Add Liquidity".

The potential returns are placed on the right hand side of the pools to help the investor weigh risk and reward.

To trade, Balancer users can invest in pools or trade on the platform. The first step is to find the crypto pair you want to trade by clicking on "Exchange" and searching for individual tokens.

Once you have found your desired trading pair, click on "Invest" under the two assets trading column. You will then see a pop-up box with instructions on how to trade the pair.

The Risks

There are a few risks with the Balancer platform.

First, even though Balancer has taken steps to create a safe and secure platform for its users, it's still decentralized and you would want to avoid using public Wi-Fi or unsecured networks. Like any platform it can be hacked or scammed. Take regular precautions with this and any other crypto investment.

Secondly, there is always a risk that the underlying assets will lose value. If an investor holds a token for an ETH/BTC pool, there is always a risk that one or both of the crypto assets may reduce in value.

Thirdly, there is the risk of what is called "impermanent loss". This risk refers to the

possibility that the values of the tokens in the pool diverge and the algorithm returns a lower value to the initial investor due to an imbalance in liquidity.

For example:

- Initial investments 100 ETH

- Pool returns 80 ETH due to an imbalance in liquidity of 30%

- Investors receive only 60 ETH instead of the initial 100. Since the ratio is already set (80/100), no matter what happens next, Balancer will return 80% of all payouts to all token holders. This means that if the pool returns 10 ETH, 90 ETH would be returned to all token holders.

For more information on impermanent loss,

see this article.

Webull Promotion

Open WeBull Account

Other Potential Drawbacks to Using Balancer

The other main drawback to using Balancer is not actually unique to Balancer. It has more to do with the frictional costs of moving assets through the Ethereum network. These frictional costs are called "gas fees." Gas fees occur when sending assets from one address to another within the network. While these fees have been reduced drastically via various methods, it still presents a barrier for investors who want to invest in a large pool and withdraw their earnings frequently.

These fees can range depending on the network activity and transaction size. Still, the frictional costs for many investors are $20-$90. This means an investor should likely bring in a large enough sum to counteract the frictional costs of moving the assets.

Balancer Review Recap

With so much information on the internet, it can be tough to sort through all of it and find what you need. This blog post is a great place to start if you’re new to cryptocurrency and blockchain technology in general. We hope this was helpful for those who are interested in learning more about Balancer DeFi trading platform. All the best in your investing!

WeBull Promotion

Open WeBull Account

|